Two weeks to Christmas

Oh goodie

Not being gainfully employed at the moment, my total festive spending will probably stretch to a few dozen 2nd class stamps and some crappy Christmas cards. That’s if I don’t leave my card writing session too late like I did last year.

I could, of course, decide to make everyone around me much happier and also treat myself to a little something by reaching for the old plastic pal and using it to spread the joy.

But I won’t.

I won’t because I’m not a fucking idiot.

Sadly, however, a lot of people out there are. I’ve just spent a little while perusing the latest UK debt statistics. I strongly recommend anyone bumping into this blog does so too. They make for truly mind-boggling reading.

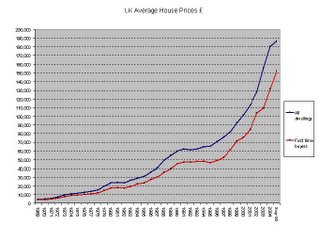

The UK average house price graph is extra specially scary. And one thing you can’t help noticing is that the graph started going berko round about the same time the UK Government handed over interest rate setting to the ‘independent’ Monetary Policy Committee (MPC) of the Bank of England.

Now the funny thing about the MPC is that just about everybody in politics and the media harps on about what a great idea that was and how it has paved the way for economic stability and the end of boom and bust economics. Dissenting voices are conspicuous by their absence.

Have another look at the average house price. No sign of any boom and bust mentality there, oh no.

What the MPC has been doing, with enthusiastic government support in the background, has been to manage interest rate levels to encourage the maximum amount of personal debt without going too far and letting the whole system go tits up.

For now anyway.

Lending is a first class con. Create some money out of thin air, stimulate demand for that money by lending it cheap, then sit back and watch the mug punters strangle themselves as they borrow more and more.

Then every now and then burst the bubble, hoover up assets on the cheap and start the process all over again.

Governments, as well as the banks, do quite nicely out of the deal, as insane borrowing levels create an illusion of prosperity for some and a financial cosh for others. Chuck in a few handfuls of good old fashioned fear; about terrorism, about killer plagues, about environmental catastrophe and you can pretty much do whatever the fuck you like.

And 2006 is shaping up to be a best-ever year for debt and fear.

And just in case any body out there retains the old fashion notion that personal debt is a bad thing, our government helpfully provides all sorts of little aids and prompts to keep us on track. Students in tertiary education are now thoughtfully set up as major debt bitches before they even start work. People who can barely make ends meet in our burgeoning service based economy, as they compete with workers from the 3rd World, are constantly assured that the economy is great and that prices are only rising by something like 2%. Well except for housing, fuel, water, transport, local taxes and minor stuff like that, oh, and money. But sod it, everyone else is doing well so why not take up that credit card offer?

And let’s face it, everyone needs somewhere to live and, yes, property is expensive but the banks are so obliging these days.

Personal debt would be a lot more fun to handle if individuals had the same rights as companies or governments. If you were a company you’d just skip on a dividend for a couple of years. If you were a government you’d just screw your employer for more money on threat of imprisonment. But, sadly, we mortals are none of these things so we have to make do with getting shafted instead.

And if all of this sounds just a teensy weensy bit demented just read through the commentaries that accompany the monthly MPC decisions. They, not the individual, decide how much money the individual has to spend each month. And the greater the individual’s debt the more direct their control.

And the magic part is that they are totally unaccountable

Fantastic!

Fuck it, why stop there? If having unaccountable bankers setting people’s spending behaviour and personal debt burden is such a marvellous idea why not have a panel of psychiatrists deciding how collectively happy we all are every month and slipping anti-depressants into our air and water supplies as well? Personally, I’m also inclined to think that management of Fear, like the interest rate, is too important to be left in the hands of mere politicians. Maybe we should have a panel of Fear experts deciding scientifically just how much Fear we can all bear without things getting out of hand? People topping their kids, then themselves, or running up and down the high street naked, that sort of thing.

That would make for an interesting set of graphs.

Why not? When you really think about it, we’re all just rats in a cage aren’t we?

3 comments:

Great (and scary) post! Very interesting.

Please don't buy those xmas cards. It's all one great big consumerist con. But you know that.

well quite

Post a Comment